The AI wars are starting to heat up.

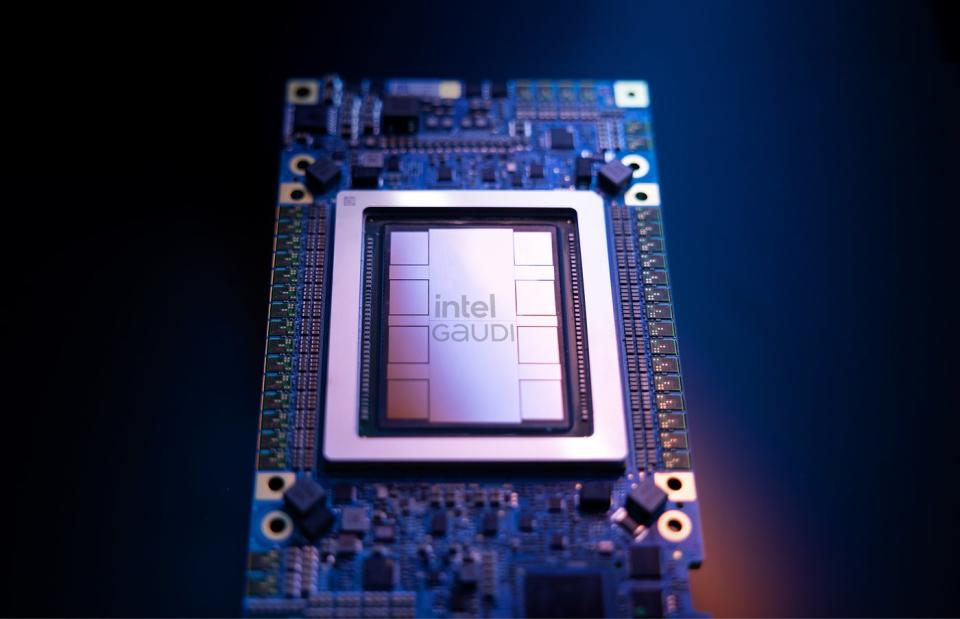

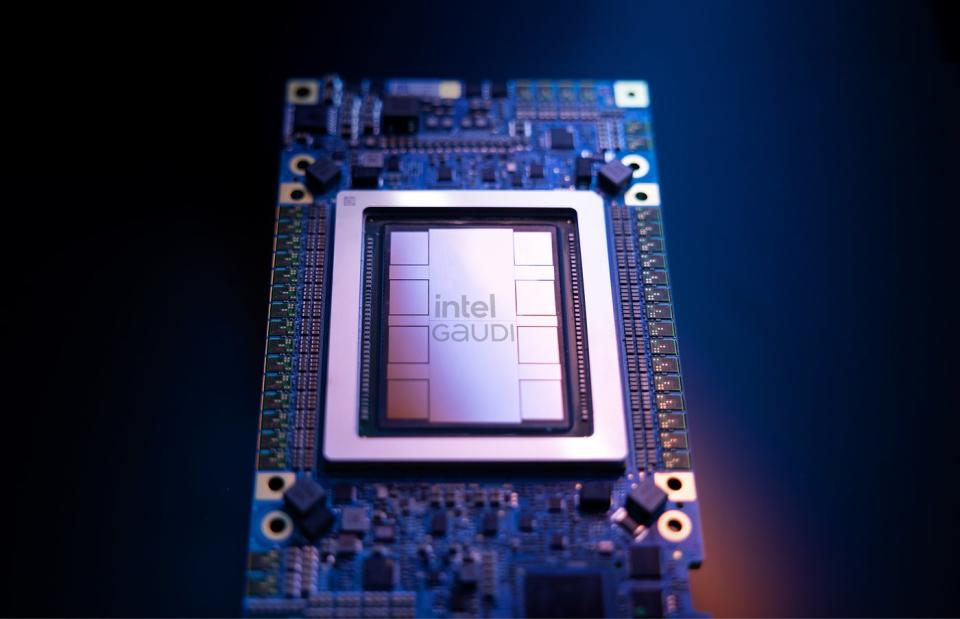

Until now, NVIDIA (NASDAQ: NVDA) has dominated the AI chip market with an estimated 98% share of the data center GPU market. However, Intel (NASDAQ: INTC) is now throwing its hat into the ring: the company launched its Gaudi 3 AI accelerator on Tuesday.

According to Intel, the new chip is well positioned to take market share from Nvidia. Intel states:

-

Gaudi 3 offers 50% better inference on average and 40% better power efficiency on average than the Nvidia H100

-

The Gaudi 3 sells for a fraction of the cost of the H100.

-

Intel said the new chip would be available to serve manufacturers such as Dell Technologies, Hewlett Packard Company, lenovoand super microcomputer.

-

He also announced new Gaudí clients and partners such as Bharti Airtel, Bosch, IBMand NielsenIQ.

Wall Street had a mostly lukewarm reaction to the news. Intel shares rose 1% on Tuesday on heavy volume, before falling 3% on Wednesday on concerns related to the higher-than-expected inflation report.

Although Intel stock has soared through 2023 on hopes of a cyclical recovery in the semiconductor sector and enthusiasm around AI, shares have plummeted in 2024, down 26% so far this year, even as the rest of the chip sector has continued to rise on the back of the AI boom. Intel slumped in January on disappointing fourth-quarter guidance, and shares fell sharply last week when the company disclosed a $7 billion loss in its foundry segment in 2023 after restructuring its business segments. The company said losses would widen this year before reaching breakeven on the foundry business by 2027, and then profitability thereafter.

Intel has a long history of underperforming its peers, and the stock is still below its peak during the dot-com boom. Over the past decade, Intel shares have gained 38%, compared to a 176% gain for the S&P 500. However, Gaudí 3 gives the company a chance to redeem itself.

What Gaudi 3 means for Intel

To get an idea of the opportunities that data center GPUs offer, just take a look at Nvidia's recent results. The leading AI chip company generated $18.4 billion in data center revenue in its fourth quarter, up 409% from the prior-year quarter. By contrast, Intel reported a 10% decline in data center revenue to $4 billion.

The good news for Intel is that it doesn't need to take much market share from Nvidia to move the needle on AI chips: even $1 billion in revenue per quarter would be significant.

There is still a significant shortage of Nvidia's AI superchips like the H100, and their components are sold at a premium, putting Intel in a good position to take some of the market. However, making a significant dent in Nvidia's AI leadership won't be so easy.

Nvidia steps up its game

Intel's press release and white paper on Gaudi 3 tout its performance against Nvidia's H100 accelerator, attributing its better performance and inference to its large high-bandwidth memory (HBM), more efficient architecture, and HBM capability. .

The problem with that comparison for Intel is that Nvidia's H100 is about to be replaced by the Blackwell platform it announced at its developer conference last month. According to Nvidia, Blackwell is four times faster than the H100 and can run large language models with trillions of parameters at up to 25 times lower cost and power needs than the H100.

Intel's Gaudi 3 may have closed the gap to the H100, but Nvidia is still winning the AI race with Blackwell, which is expected to be available later this year.

Additionally, Nvidia's CUDA software platform, which includes development tools and libraries to help create AI applications, also gives Nvidia an advantage over rivals such as Intel, which is trying to match CUDA's capabilities with a Open Source.

Finally, Intel's cost advantage could also be a smaller benefit than it seems. There are billions and billions of dollars wasting the generative AI market right now, and investors and companies are willing to shell out money at this stage to gain a sustainable advantage in generative AI, which could be a multi-billion dollar market.

While some customers may be more price-sensitive than others, computing capabilities, speed and capacity are the key elements that Nvidia, Intel and others like. Advanced Micro Devices They are competing here, rather than on price.

For Intel, dethroning Nvidia will be difficult: the leader in AI chips has been investing in this technology for several years, has a complementary software platform in CUDA, and will fight for market share in what now represents the vast majority of its income.

Intel may make enough revenue to make investors happy, but Gaudi 3 is unlikely to lead to a complete shift in AI leadership from Nvidia to Intel. Nvidia investors shouldn't worry right now.

Should you invest $1,000 in Intel right now?

Before you buy Intel stock, consider this:

He Varied and Dumb Stock Advisor The analyst team has just identified what they believe are the 10 best stocks for investors to buy now… and Intel was not one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow success plan, including guidance on how to build a portfolio, regular analyst updates, and two new stock picks each month. He Stock Advisor The service has more than tripled the performance of the S&P 500 since 2002*.

*Stock Advisor returns from April 8, 2024

Jeremy Bowman has no position in any of the stocks mentioned. The Motley Fool has positions and recommends Advanced Micro Devices and Nvidia. The Motley Fool recommends Intel and International Business Machines and recommends the following options: long $57.50 January 2023 calls on Intel, long $45 January 2025 calls on Intel, and short $47 May 2024 calls at Intel. The Motley Fool has a disclosure policy.

Intel presented its new artificial intelligence chip: can it compete with Nvidia? was originally published by The Motley Fool