In the latest market whirlwind, the Dow Jones Industrial Average took a steep 251-point dive as Federal Reserve Chair Jerome Powell addressed concerns about inflation and interest rates. On a brighter note, Netflix witnessed a staggering surge in stock prices following their impressive earnings report, while Tesla’s stocks plunged in response to Elon Musk’s ominous Cybertruck warning. Meanwhile, Microsoft made gains, and a trio of promising stocks continue to hold strong near buy points: HealthEquity, Vistra, and Cencora.

Watch the video at Investors.com – Discover the Secret to Effortless Investing and Maximize Long-Term Gains!

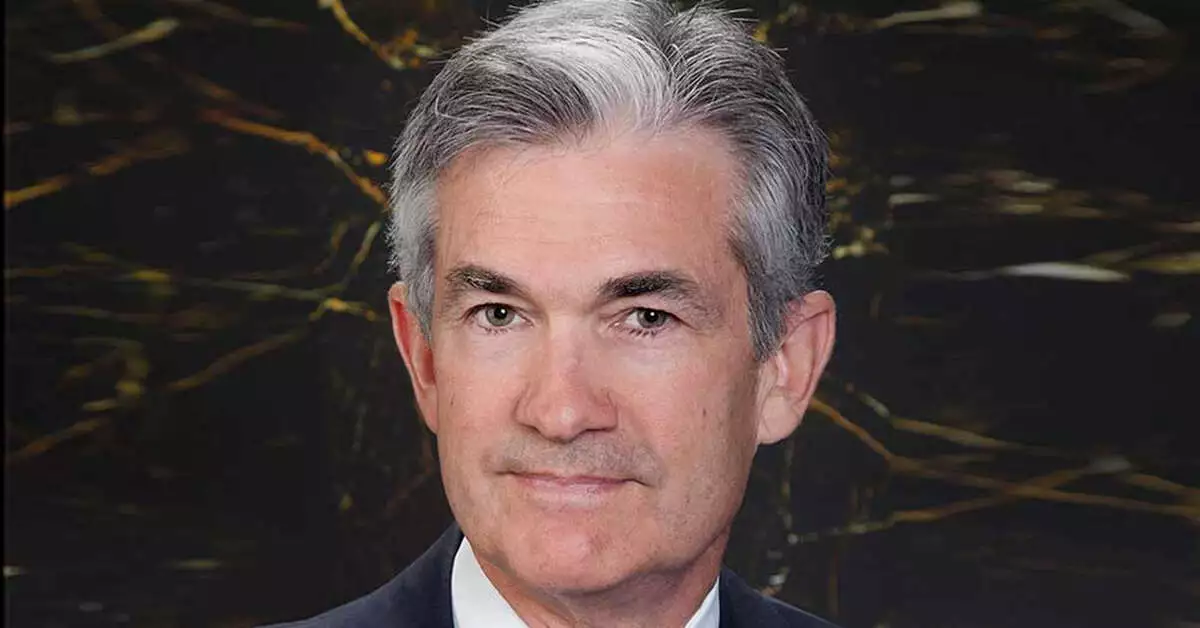

Powell’s Pledge on Interest Rates and Inflation

Stocks went on a wild ride after Powell’s speech at the Economic Club of New York, tumbling in the final 90 minutes. Powell emphasized the importance of proceeding cautiously, indicating that there’s no rush to raise rates. He also noted the significance of rising Treasury yields in the Fed’s decision-making process, emphasizing that changes in financial conditions could impact monetary policy. However, he didn’t rule out the possibility of further tightening if strong economic data continues, leaving some investors concerned about the central bank’s enormous balance sheet.

Mixed Treasury Yields

The 10-year yield soared by 8 basis points to 4.98%, with the ominous 5% level looming on the horizon. In contrast, the two-year yield dropped 6 basis points to 5.15%, maintaining the yield curve’s inverted status.

Market Data

Today’s economic data presented a mixed picture. Weekly first-time claims for unemployment assistance surprisingly fell to 198,000, defying expectations, and showing the robust state of the job market. The Philadelphia Fed’s Manufacturing Index improved in October, further highlighting the market’s unpredictability.

Nasdaq Slips as Small Caps Struggle

The Nasdaq experienced the most significant decline among major indexes, ending with a 1% loss after a brief rally. Lam Research faced a substantial drop of 6.3% after its earnings report. Meanwhile, the S&P 500 had a turbulent day, ultimately sliding by 0.9%. AT&T, a notable mover, gained 6.6% on a positive earnings report. Consumer discretionary and real estate sectors lagged behind in the stock market today, with only the S&P Communication Services sector showing modest gains.

ALSO READ: Shocking Revelation: Taiwan Semiconductor CEO’s Bold Statement About AI Demand

Dow Jones Today: Verizon and Microsoft Shine

The Dow Jones Industrial Average faced substantial fluctuations and ultimately dropped by around 251 points, or 0.8%. Verizon Communications saw a 1.7% increase following AT&T’s report, while Salesforce and McDonald’s also made gains. Microsoft performed well, rising 0.4%, though it pulled back from its session highs. In contrast, Travelers, Caterpillar, and Walt Disney struggled.

Netflix’s Earnings Surge

Netflix was a shining star, with its stock surging by an impressive 16.1%. The company’s strong earnings, with an EPS of $3.73, exceeded expectations, driven by an increase in subscribers and a crackdown on account sharing. Morgan Stanley rewarded Netflix with a rating upgrade to overweight, making it an attractive prospect for aggressive investors.

Tesla Faces a Bearish Attack

Tesla stocks plummeted by 9.3% after missing earnings and sales expectations. Elon Musk’s warning about the challenges in reaching volume production with the Cybertruck and economic concerns due to rising interest rates further contributed to the stock’s decline. Tesla’s cup-with-handle base was severely affected, plummeting below its 50-day line and possibly heading towards a test of its 200-day moving average.

Looking Beyond the Dow Jones: Three Stocks to Watch

In these volatile market conditions, it’s essential to build up your watchlist. HealthEquity made progress towards a cup-with-handle entry, Vistra is forming a flat base with an attractive entry point, and Cencora is approaching a cup base buy point, with a promising relative strength line.

Stay informed and ready for the market’s next move as it continues to be unpredictable.

ALSO READ: Electric Truck Rival of Tesla and Volvo Declares Bankruptcy Amid Battery Supplier Woes

Goldman Sachs Q3 Earnings: Is CEO David Solomon’s Turnaround Strategy Paying Off?