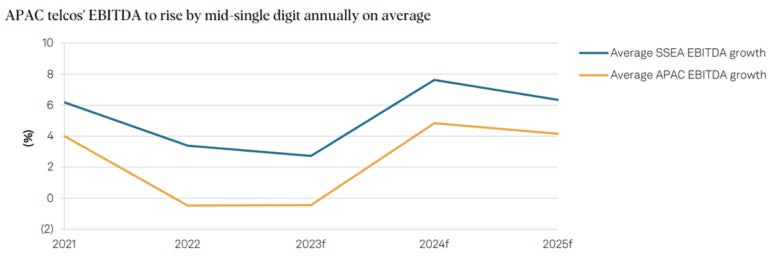

Telcos in the Asia-Pacific region have entered 2024 facing cost pressures amid limited returns on their 5G investments to date. S&P Global Ratings Forecasts that while 5G adoption in many APAC markets remains too low to increase revenues, price increases, such as those for labor and electricity, are reducing margins.

Costs pressure a major factor for AI and product innovation

Telecommunications company Telstra in Australia and other telecommunications companies in the region are responding with efforts to innovate and increase their revenues. According to Jayanth Nagarajan, Director of Telecommunications at Amazon Web Services in Asia-Pacific and Japan, the key topics that will dominate the agendas of regional telecommunications executives in 2024 include:

- Leverage data, generative AI, and machine learning at scale.

- Build resilient, cost-effective and robust core networks.

- Increase business income through new products and services.

“Telecom companies are critical infrastructure with a national mandate in many countries, so the deployment of resilient and cost-effective 5G networks is a given,” Nagarajan said. “But the corollary of this is that cost pressures are real across the industry, and there is a focus on looking for ways to build more resilient solutions while reducing total cost of ownership.” (Figure A)

AI is a priority for Asia-Pacific telcos

Artificial intelligence occupied a prominent place in the Mobile World Congress 2024. While early use cases for telcos focused on improving customer service and employee productivity, Nagarajan notes that cost pressures mean telcos now see AI as more than just an engine. search engine or a chatbot, with use cases that include network optimization.

Customer service, employee productivity and networking are key use cases

A large number of telcos identified immediate use cases in the areas of customer service and employee productivity. According to AWS, just a few of them include forecasting future customer needs, suggesting retention offers, and personalizing customer recommendations to create a connected customer journey.

“We're also seeing a lot of employee productivity use cases, such as automating responses to RFPs and providing training and support,” Nagarajan explained, including giving engineers access to enterprise knowledge bases while they're in the field.

However, Nagarajan said telecom companies are now also increasingly using AI to help optimize and automate networks, including intelligent planning, deployment and troubleshooting of their networks.

SEE: How Australian and New Zealand telcos are embracing AI use cases.

“We are starting to see the use of AI in areas like the radio network and SMO layer to drive more granular control over radio towers and how they radiate,” Nagarajan said. “This makes them much more energy efficient. Telecom companies need a lot of energy, so any reduction in energy use is something they can pass on to the CFO and the company.”

Telstra sees AI becoming an integrated part of network software

Telstra, Australia's leading telecommunications company, has been using AI “for a very long time”, according to Channa Seneviratne, network technology innovation and development executive at Telstra. Telstra CEO Vicki Brady recently revealed that AI was already being used to improve half of the telco's key processes. This included automatically detecting and resolving repaired service faults, as well as resolving customer issues faster.

Seneviratne said that while the deployment of AI was important from a customer service point of view, it would also become increasingly important for networks.

“What we will see as we move towards 5G, 5G-Advanced and then 6G is that AI will be more integrated into the network platform,” Seneviratne said. “So offline AI is there, but what we will see in the future is greater integration of AI and machine learning models into software.”

Telecommunications companies build resilient, profitable and robust core networks

The resilience and cost-effectiveness of core telecommunications networks has become critical. For example, Telstra is using AI in its effort to make its network more automated, efficient, resilient and secure, but this means the need for GPUs is increasing. Telstra cloud and network applications executive Shailin Sehgal said Telstra has needed to leave enough room in its energy budget to make this efficient and sustainable.

SEE: IBM Consulting sees evidence of innovation in AI implementations in Australia.

In February 2024, Telstra announced a deployment of Ericsson's bare metal cloud environment, also known as a cloud-native infrastructure solution, which can boost 5G core efficiency with high-density microprocessors from Advanced Micro Devices. With closed-loop liquid cooling, power consumption is reduced by 49%, which it describes as “a huge technological leap” for its private cloud infrastructure.

Telecommunications companies make greater use of cloud services

According to Nagarajan, telcos have been intensifying their use of the cloud to support network resilience and reduce costs. AWS has seen more BSS and OSS applications moving to scale, as well as more networking workloads. There was also an expansion of new use cases, including the use of cloud elasticity to improve resilience and disaster recovery among telecom companies.

Landmark Telstra trial uses AWS to increase network resilience in a crisis

Telstra recently announced a Hybrid network architecture resilience test. that would ensure continuity of voice calls during unplanned network outages, when the primary solution is not working properly. Using Nokia's IP Multimedia Subsystem software in collaboration with cloud provider AWS, Telstra said the trial showed the potential for on-demand capacity in an unplanned network outage scenario.

“When deployed at scale, this will provide greater network resilience by allowing call control to be supported by the cloud, rather than experiencing a network outage,” Telstra said in a statement.

Telstra is working with AWS and Nokia to expand the trial beyond Voice over LTE on IMS, with the hope it can include the full scale of services provided by the network, including data services such as Eftpos and text messaging.

Increase business income through new products and services.

Telecom companies are looking for new ways to increase revenue.

“They are looking to innovate faster and build internal capabilities to develop and introduce new services for their customers,” Nagarajan explained. “But we all know the challenges the industry faces; “legacy applications, long-standing traditional workforce development processes, steeped in legacy regulatory environments.”

Monetizing 5G is a priority in the Asia-Pacific region

Much of the focus is on monetizing investments in 5G networks.

“Over the last few years I think we've heard the promise of additional revenue from 5G, but we have yet to see that windfall that is the reality check,” Nagarajan said.

Telstra, for example, has seen its 5G coverage increase to 87% of the Australian population by early 2024, with 48% of mobile traffic now on 5G, although not all of it is standalone 5G.

Nagarajan argues that 2023 could have marked a turning point for 5G, with global and Asia Pacific 5G coverage growing, devices starting to catch up, and use cases for 5G technologies becoming more sophisticated.

“The final barrier to realizing the potential of 5G is the industry-wide community and cross-functional partnerships needed to create 5G services and reduce barriers to accelerate innovation,” Nagarajan said.

Telcos turn to APIs to increase revenue

Nagarajan said one avenue for growth has been for operators to expose network capabilities through APIs. This allows telcos to leverage the developer community to bring together services from multiple parties to deliver one result to the end customer.

Telstra to offer 5G slicing product for business customers

Telstra announced in February 2024 would bring a 5G cutting product to the market in 2024, which could offer guaranteed 5G performance to paying enterprise customers. Following the development of a new proof-of-value engine, which can analyze 5G traffic every second to check whether a customer has received the committed performance, Telstra has said it will be able to create multiple virtual networks with different performance characteristics. so that companies can access customized 5G solutions.