10,000 Hours | Digital vision | fake images

There's still time to reduce your 2023 tax bill or boost your refund with a lesser-known retirement savings strategy for married couples.

A requirement for IRA contributions is “earned income,” such as wages or salaries from a job or income from self-employment. But there is an exception for single-income households: the spousal IRA.

A spousal IRA is a separate Roth or traditional IRA for the non-working spouse, and “often overlooked,” according to certified financial planner Judy Brown of SC&H Group in the Washington, D.C. and Baltimore area.

These accounts can provide a tax reduction for the current year and increase retirement savings for non-earning spouses. In 2021, about 18% of parents did not work outside the home and the majority of stay-at-home parents were women. according to the Pew Research Center.

“My advice to [nonearning] “Women should make sure they're at least doing that spousal IRA,” said CFP Catherine Valega, founder of Boston-based Green Bee Advisory.

My advice for [nonearning] women should make sure you are at least doing that spousal IRA.

Catalina Valega

Founder of Green Bee Advisory

How the Spousal IRA Works

Traditional contributions to a pre-tax spousal IRA can provide a tax break for 2023, depending on income and participation in the workplace retirement plan, explained Brown, who is also a certified public accountant.

With income phasing out for IRA deductibility and Roth IRA contributions, many are waiting until March or April for prior year IRA deposits. It can be a “game-time decision” while doing your taxes, Brown said.

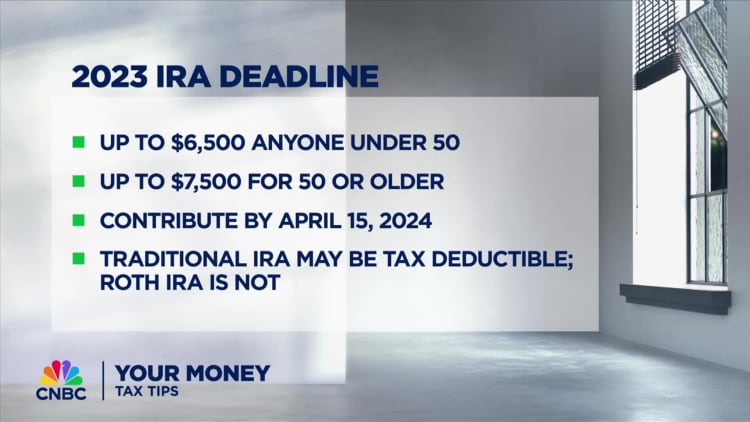

The annual IRA contribution limit is $6,500 by 2023 or $7,500 for savers age 50 and older. The limit increased to $7,000 by 2024, with an additional $1,000 for investors age 50 and older.

However, “it doesn't have to be all or nothing,” Brown said. Even a spousal IRA contribution of $500 or $1,000 could result in tax savings.

Contributions could create a 'tax problem'

While spousal IRA contributions make sense for some couples, there are other factors to consider before making deposits, said CFP Laura Mattia, CEO of Atlas Fiduciary Financial in Sarasota, Florida.

For example, some couples need extra money for living expenses or short-term goals, like paying for a wedding, he said.

Additionally, too much pre-tax retirement savings could create a “tax problem” down the road, depending on the size of your accounts and your future prospects. required minimum distributions, Mattia said. Pre-tax withdrawals increase income, which can affect Medicare Parts B and D premiums, among other consequences.

“It's an enigma and it really depends on a lot of things,” he added.