Edge computing is often predicted to be a technology that will revolutionize business computing in Australia. By capturing, processing, analyzing and storing data at the edge, rather than in a central location, its promises include fast real-time computing at the edge and less cost.

While Edge has yet to deliver on these promises, adoption is happening. Utpal Mangla, general manager of industrial edge cloud and distributed cloud platform at IBM, said the edge is being deployed for specific use cases globally, including quality control in manufacturing.

The growth of AI may drive the trend, as some use cases reach the limit. Mangla maintains that a “hybrid cloud by design” approach is the best option for companies looking to prepare for a future in which they will need to combine on-premises, cloud and edge computing.

Has edge computing fulfilled its promise?

Australia should be a prime candidate for edge computing growth. With a population of 25 million living in an area the size of the United States or Europe, the potential to process data at the edge, rather than in centralized data centers or the cloud, appears attractive to businesses.

SEE: The current state of edge computing.

But as elsewhere, the lead has not taken off at the pace some had anticipated.

“He [global] The industry has been saying for five, seven, eight years that it was coming and it would change the world,” IBM's Mangla told TechRepublic. “Has it turned out as analysts and companies see it? “Probably in terms of monetization it hasn’t reached that scale yet.”

Monetization of 5G investments is a symptom of slower growth

Telecommunications companies such as Telstra have invested billions in 5G infrastructure. The hope was that 5G's high bandwidth, low latency, and capabilities like network slicing would make the promise of the edge a reality. Monetization was to be achieved through commercial clients.

However, a study commissioned by Telstra in 2022-23 described adoption as “nascent” at the time, with only 25% of businesses. It found that leaders were exploring cloud adoption and that vendor investments were accelerating customer journeys and advancing hybrid cloud plans.

Global markets show gap between future potential and adoption

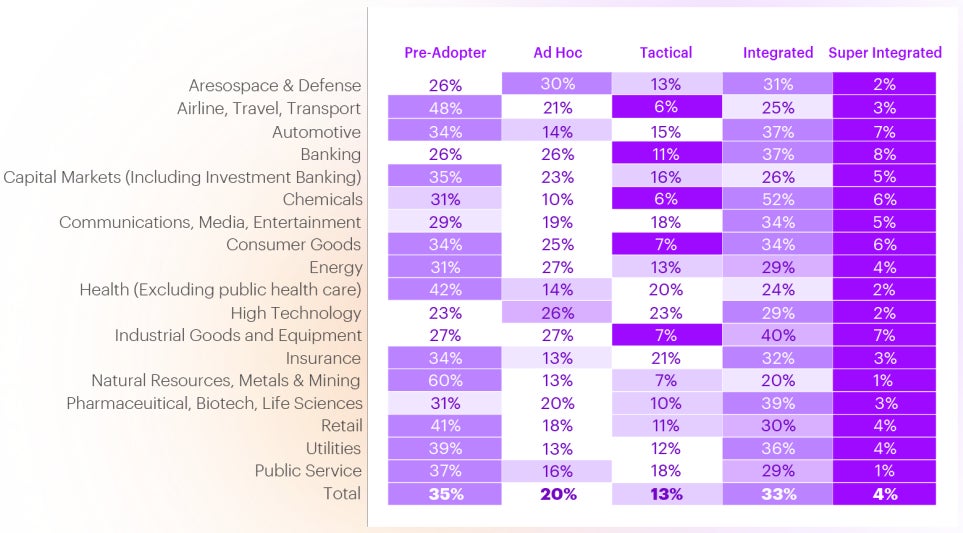

An Accenture survey of 2,100 C-level executives in 18 countries found that 83% still believe the edge will be essential to remaining competitive in the future. However, only 65% were using edge computing, and 50% of them were only “ad hoc” or “tactical” users of edge computing (Figure A).

Why hasn't the edge taken off as much as it could have?

The slower-than-expected margin growth was partly due to overstated predictions.

“Some things were a little over the top. There was always a need to create use cases, build businesses, implement things to realize the potential of edge computing,” Mangla said.

However, there are other barriers that the edge computing industry faces in its implementation.

SEE: Consider these edge computing best practices.

Return on Investment for Enterprise Edge Computing Use Cases

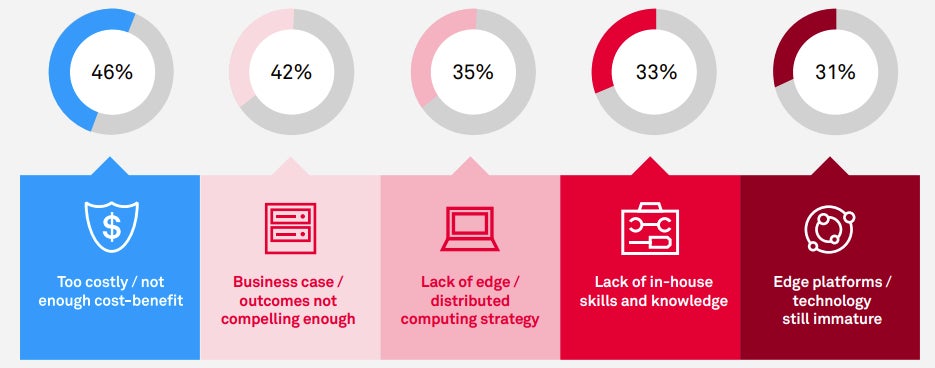

While presented as a way to rationalize costs through a reduction in data transfer costs, the advantage has actually proven to be more costly in some cases. Telstra's 2022-23 State of Cloud, Edge and Security Survey found that 46% of businesses were discouraged by low cost-effectiveness ratios.

Forty-two percent found the business cases and results not compelling enough (Figure B), which was attributed to an “insufficient understanding of the benefits of advantage in terms of return on investment and competitive differentiation.” Companies were also experiencing gaps in cutting-edge skills and strategies.

Complexity and extensibility of cutting-edge computing technology in the process of maturation.

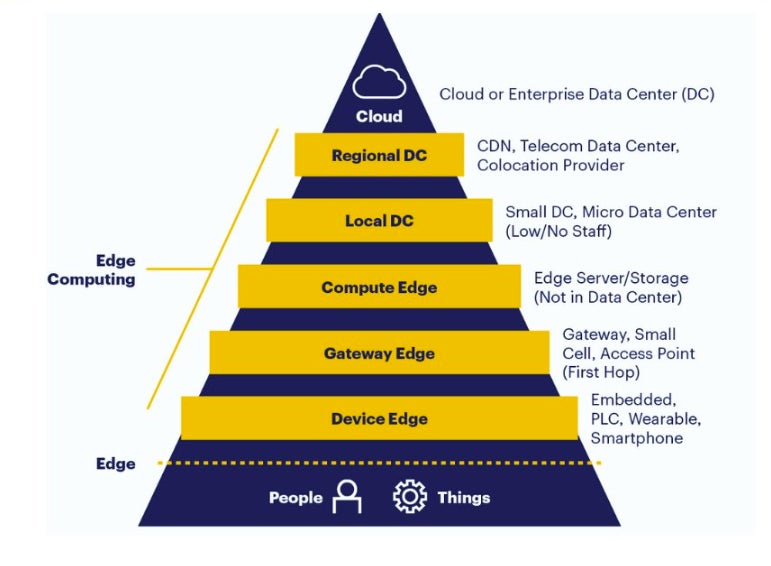

The depth of the edge computing market also means that it faces the challenge of a lack of a standard edge computing stack and APIs (Figure C). This has made it difficult to develop and deploy edge applications that can run across different edge computing platforms and devices.

Edge computing use cases have tended to be vertical-specific. With differences between industries and use cases, this means that investment is also fragmented, at least until individual industries determine consistent architectural approaches to capture the value of the advantage.

Where does the border find a useful place in the landscape?

Edge computing is growing in Australia and around the world, even if this may seem disappointing due to inflated expectations. Mangla noted that IBM customers are actively deploying edge computing in industry-specific use cases around the world.

Manufacturers implement cutting-edge technologies for industrial flooring

A good example is industrial land. Mangla said many organizations with manufacturing operations that want world-class inspection and quality control are increasing manual inspections by implementing edge computing for visual inspection on the shop floor.

Epicor, a manufacturing execution systems provider in the Australian and regional market, is just one technology provider that is actively working with local manufacturers to supercharge operations through smart factory initiatives that further automate operations.

Automotive and mining sectors improve decision making at the edge

IBM has worked with automotive clients using the edge to monitor stock levels on parking lots during supply chain disruptions. The advantage is also driving autonomous driving features for automakers, enabling split-second decisions without the latency of cloud connectivity.

Australian miners are forward adopters. Newcrest iron ore mine is using smart edge to extract data from downstream sensors that monitor tonnes dumped, platform feeder speeds and weighers to control the volume of ore delivered to upstream crushed ore bins.

Industries implementing industry-specific use cases for edge computing

McKinsey & Company Research indicates that industries exploring the potential of edge computing include everything from aerospace and defense, chemicals and electric power, natural gas and utilities, to financial services, healthcare systems and retail. .

Could AI accelerate adoption of advantage in Australia?

Australia is ripe for growth in edge computing, Mangla said. During a recent visit to Sydney, he noted there were startups looking to run AI visual recognition technology for industries at the edge, and New Zealand companies looking at the edge for their manufacturing operations.

SEE: Australia is well positioned to capitalize on the future influence of AI.

Mangla said edge computing could accelerate thanks to AI because some use cases adapt to the edge. Mangla said the edge really excels when decisions must be made quickly in the moment and where it is best to avoid waiting for data to be transferred to centralized locations.

'Hybrid cloud by design' mentality will underpin Australian edge computing

Organizations looking to make the most of edge computing, as well as the rest of their cloud infrastructure, should take a “hybrid cloud by design” approach, Mangla said. While much of the market had stumbled organically with a mix of on-premises and cloud infrastructure and services, he said this would be better managed with intentional adoption of hybrid cloud in the future.

“When you think about strategy, there will always be more than one cloud,” he said. “You will always have something, the crown jewels, that you will never put in a cloud environment, you will always have it in a local or private cloud. Australian government agencies like the ATO will never put anything in the public cloud.

“As new applications are created, make sure they can run smoothly across… the entire landscape. “As you start to build it intentionally over the next 10 to 15 years, as you modernize applications, you will need a hybrid cloud with a design mindset.”